Understanding the way that companies calculate their payback period is also helpful to determine their financial viability and whether it makes sense for you to invest in them as part of your portfolio. Calculating payback periods is especially important for startup companies with limited capital that want to be sure they can recoup their money without going out of business. Companies also use the payback period to select between different investment opportunities or to help them understand the risk-reward ratio of a given investment. Using the averaging method, the initial amount of the investment is divided by annualized cash flows an investment is projected to generate. This works well if cash flows are predictable or expected to be consistent over time, but otherwise this method may not be very accurate. • Equity firms may calculate the payback period for potential investment in startups and other companies to ensure capital recoupment and understand risk-reward ratios.

FAQs About Discounted Payback Period

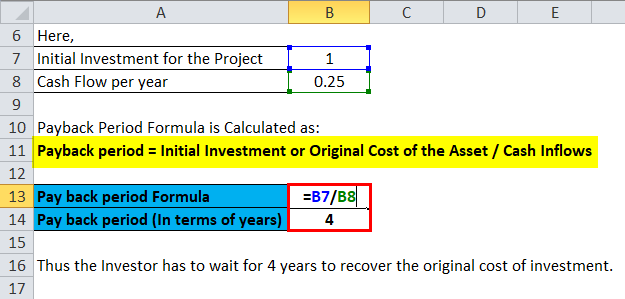

One of the most important capital budgeting techniques businesses can practice is known as the payback period method or payback analysis. That’s why business owners and managers need to use capital budgeting techniques to determine which projects will deliver the best returns, and yield the most profitable outcome. Conceptually, the payback period is the amount of time between the date of the initial investment (i.e., project cost) and the date when the break-even point has been reached. The answer is found by dividing $200,000 by $100,000, which is two years.

Cash Flow and Liquidity Management

In studying “Investment Decisions” for the CMA, you should learn to evaluate various types of investments by analyzing cash flows, risks, and returns to make sound financial decisions. Understand capital budgeting techniques, including net present value (NPV), internal rate of return (IRR), and payback period, and how to apply them to assess project viability. Analyze the impact of investment decisions on a company’s financial health and strategic goals. Evaluate the role of cost of capital in decision-making and explore the trade-offs between risk and return. Additionally, gain proficiency in performing sensitivity analyses to assess how changes in assumptions affect investment outcomes, preparing you to make informed, data-driven decisions.

Advantages and disadvantages of payback method:

If we divide $1 million by $250,000, we arrive at a payback period of four years for this investment. Others like to use it as an additional point of reference in a capital budgeting decision framework. • Downsides of using the payback period include that it does take into account the time value of money or other ways an investment might bring value. • The payback period is the estimated amount of time it will take to recoup an investment or to break even.

Example 1: Even Cash Flows

- The simple payback period doesn’t take into account money’s time value.

- Discounted payback period calculation is a simple way to analyze an investment.

- WACC is the calculation of a firm’s cost of capital, where each category of capital, such as equity or bonds, is proportionately weighted.

- You’ll examine capital budgeting techniques, including net present value, internal rate of return, and payback period, to assess potential investments.

- This section covers risk analysis, cost of capital, and the evaluation of long-term financial projects.

The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. Knowing the payback period is helpful if there’s a risk of a project ending in the future. For example, if a company might lose a lease or a contract, the sooner they can recoup any investments they’re making into their business the less risk they have of losing that capital. The payback period equation also doesn’t take into account the effects an investment might have on the rest of the company’s operations. For instance, new equipment might require a significant amount of expensive power, or might not be able to run as often as it would need to in order to reach the payback goal.

Additional Cash Flows

The management of Health Supplement Inc. wants to reduce its labor cost by installing a new machine in its production process. For this purpose, two types of machines are available in the market – Machine X and Machine Y. Machine X would cost $18,000 where as Machine Y would cost $15,000. In this guide, we’ll be covering what the payback period is, what are the pros and cons of the method, and how you can calculate it, with concrete business examples. The first column (Cash Flows) tracks the cash flows of each year – for instance, Year 0 reflects the $10mm outlay whereas the others account for the $4mm inflow of cash flows. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. If you have any questions or need help getting started, SoFi has a team of professional financial advisors available to help you reach your personal financial goals.

Management will set an acceptable payback period for individual investments based on whether the management is risk averse or risk taking. This target may be different for different projects because higher risk corresponds collector greene county with higher return thus longer payback period being acceptable for profitable projects. For lower return projects, management will only accept the project if the risk is low which means payback period must be short.

It’s similar to determining how much money the investor currently needs to invest at this same rate in order to get the same cash flows at the same time in the future. Discount rate is useful because it can take future expected payments from different periods and discount everything to a single point in time for comparison purposes. Payback period refers to how many years it will take to pay back the initial investment. The simple payback period doesn’t take into account money’s time value.

Management uses the cash payback period equation to see how quickly they will get the company’s money back from an investment—the quicker the better. In Jim’s example, he has the option of purchasing equipment that will be paid back 40 weeks or 100 weeks. It’s obvious that he should choose the 40-week investment because after he earns his money back from the buffer, he can reinvest it in the sand blaster.

Each company will internally have its own set of standards for the timing criteria related to accepting (or declining) a project, but the industry that the company operates within also plays a critical role. In most cases, this is a pretty good payback period as experts say it can take as much as 7 to 10 years for residential homeowners in the United States to break even on their investment. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.