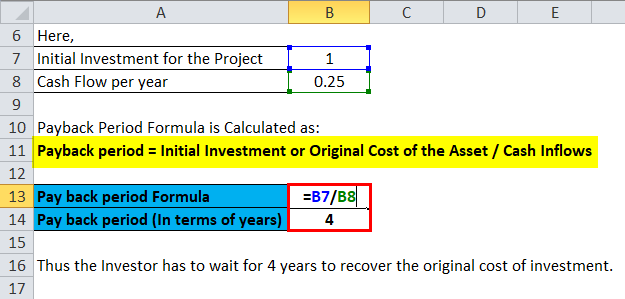

This section covers risk analysis, cost of capital, and the evaluation of long-term financial projects. Since the concept helps compute payback period with the breakeven point, the investor can easily plan their financial strategies further and make more decisions regarding the next step. It is calculated by dividing the investment made by the cash flow received every year. This is a valuable metric for fund managers and analysts who use it to determine the feasibility of an investment.

Internal Rate of Return (IRR)

Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year. The payback period calculation tells us it will take him 6 years to get his money back. When he does, the $720,000 he receives will not be equal to the original $720,000 he invested. This is because inflation over those 6 years will have decreased the value of the dollar. No such discount is allocated for in the payback period calculation. This means that it will actually take Jimmy longer than 6 years to get back his original investment.

Formula

Essentially, you can determine how long you’re going to need until your original investment amount is equal to other cash flows. We will also cover the formula to calculate it and some of the biggest advantages and disadvantages. Firstly, it fails to consider the time value of money, as cash flow obtained in the initial years of a project is valued more highly than cash flow received later in the project’s process.

How to calculate payback period with irregular cash flows

Despite the simplicity and ease of use, considering other metrics like NPV and IRR is imperative to encompassing a project’s true financial impact and ensuring a balanced investment decision-making process. Take an example where a project requires an initial investment of $150,000. In its first three years, the project is expected to return net cash of $10,000, $25,000, and $50,000. Obviously, the longer it takes an investment to recoup its original cost, the more risky the investment. In most cases, a longer payback period also means a less lucrative investment as well.

Example 1: Even Cash Flows

The payback period method is particularly helpful to a company that is small and doesn’t have a large amount of investments in play. Unlike the regular payback period, the discounted payback period metric considers this depreciation of your money. The value obtained using the discounted payback period calculator will be closer to reality, although undoubtedly more pessimistic.

Discounted Payback Period: Definition, Formula & Calculation

For instance, two projects may have the same payback period, but one generates more cash flow in the early years and the other generates more profitability in the later years. In this case, the payback method does not provide a strong indication as to which project to choose. Any particular project or investment can have a short or long payback period. How investors understand that period will depend on their time horizon. The payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year.

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Whether you’re new to investing or already have a portfolio started, there are many tools available to help you be successful. One great online investing tool is SoFi Invest® online brokerage platform. The investing platform lets you research and track your favorite stocks and ETFs. You can easily buy and sell with just a few clicks on your phone, and view your portfolio on one simple dashboard.

The main advantage is that the metric takes into account money’s time value. This is important because money today is worth more than money in the future. The discount rate represents the opportunity cost of investing your money. The payback period can help investors decide between different investments that may have a lot of similarities, as they’ll often want to choose the one that will pay back in the shortest amount of time.

When cash flows are NOT uniform over the use full life of the asset, then the cumulative cash flow from operations must be calculated for each year. In this case, the payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay. One of the biggest advantages of the payback period method after a divorce, only one parent can claim child is its simplicity. The method is extremely simple to understand, as it only requires one straightforward calculation. Hence, it’s an easy way to compare several projects and then to choose the project that has the shortest payback time. Payback period is a fundamental investment appraisal technique in corporate financial management.

- The investing platform lets you research and track your favorite stocks and ETFs.

- Considering Tesla’s warranty is only limited to 10 years, the payback period higher than 10 years is not idea.

- A young professional decides to contribute to a retirement account, such as a 401(k) or an IRA.

- • The payback period is the estimated amount of time it will take to recoup an investment or to break even.

The payback period doesn’t take into consideration other ways an investment might bring value, such as partnerships or brand awareness. This can result in investors overlooking the long-term benefits of the investment since they’re too focused on short-term ROI. The cost of capital guides the company’s capital structure decisions, helping determine the optimal mix of debt and equity financing.

The purchase of machine would be desirable if it promises a payback period of 5 years or less. Payback period doesn’t take into account money’s time value or cash flows beyond payback period. Discounted payback period refers to time needed to recoup your original investment.